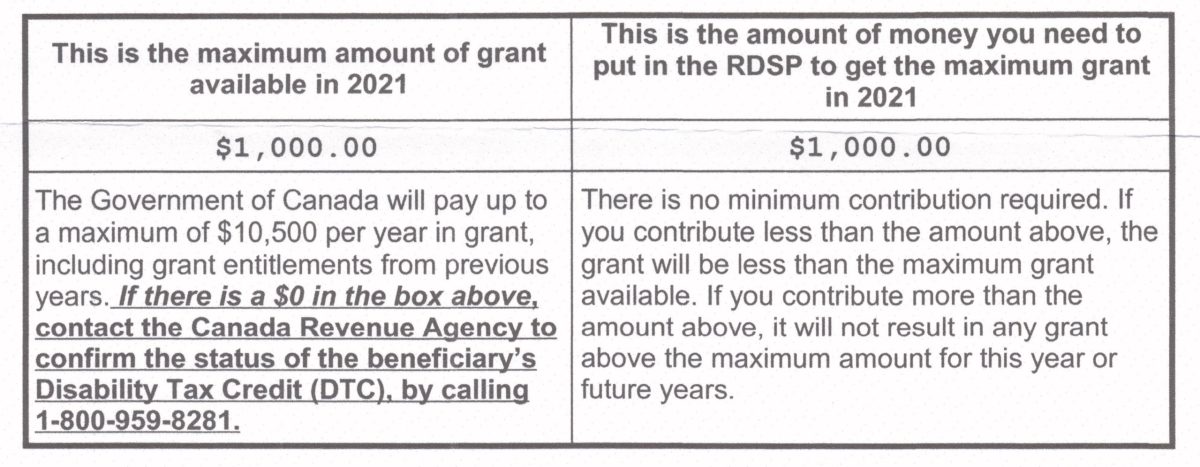

Every year, an RDSP holder gets an update about how much money can be put into their RDSP. The Statement of Grant Entitlement says how much money and how much the government will match with a Grant.

As you can see this is an important piece of information. I now know, in 2021, I can deposit $1000 in my son’s RDSP and it will be matched with $1000 in grants.

This amount will increase once my son is over 17, as the income they will use to determine the grant will be his income instead of our household income. When he turns 18, his grants should be much higher due to his estimated income at that age.

When he turns 18, my son will also have to re-qualify for his Disability Tax Credit as well. This is what we learned from the last time he had to re-qualify. Luckily the rules if he should not get a DTC right away, have changed.

The Grant and Bond entitlement calculations will be based on your son’s income the year he turns 19 (not 17). However, for the year he turns 19, they will look at his income from the year he turned 17. They always use the income from the 2nd year previous to the year in question. So, make sure you file his taxes for the year he turns 17 and every year thereafter. Without it, the gov will assume his income exceeds the grant threshold where the entitlement is $1,000.

You will also need to submit a new government grant/bond application, preferably the year he turns 18.

P.S. sorry meant to mention that part of the reason they don’t want to go through the process is that they are concerned that he could lose his ODSB status. It should be one approval for both with the same criteria.

DTC and ODSP are not connected, I have heard. Try to get the DTC again, with a Doctor who knows what he/she is doing.

At least the rules are now, that if the DTC is lost the RDSP does not need to be closed, it can hang there, until the DTC is re-attained. No problem with ranting, the whole process is p

Why do they make people requalify? It’s so stupid especially now that they’ve changed up the process. My brother receives ODSB (Ontario DISABILITY Support Benefit). he has received this his whole life (he’s 39). He had the DTC at one point and even opened up an RDSP. At some point they required him to requalify but he didn’t do the steps. Duh, he has a disability that involves cognitive processing. Do they realize he may not know the importance of this? I found this out by accident when reviewing my dads will including a Henson Trust. I was looking at my dads tax returns and he (my dad) who is widowed was not claiming him as a dependent (he lives with dad) or claiming the transferred DTC. When I inquired everyone (my dad and brother) rolled their eyes about government paperwork etc. My dad is 85 and English is not his first language so he doesn’t always grasp government speak. I’m a person who never leaves free money on the table so this irritates me. (Un)fortunately my dad has no more RRIF investments so the possibility of tax free rollover is not an issue. I am trying to groom my young replacement life insurance rep into becoming an expert in this subject, mainly because there are so few. My dads investment advisor or accountant should have caught the lapse of the DTC. Ok ranting over.

Likely to be hugely beneficial for your brother to requalify for the DTC. If he qualifies and if he then opens an RDSP he will be entitled to back years of the RDSP bond [ $1,000 per year if low income to max of 20,000]. He could also make contributions for back years e.g. contribute $1,500 per year and free government matching of $3,500. Much will depend on income level and how much the gov. has put into the former RDSP.

Best independent sources of information is the non- profit where the idea of the RDSP was hatched.

https://planinstitute.ca/

They have an excellent help line

, on line webinars,

https://www.rdsp.com/

and links to useful calculator

https://www.rdsp.com/calculator/